Navigating the 2025 IRS Calendar for Direct Deposit: A Complete Information

Associated Articles: Navigating the 2025 IRS Calendar for Direct Deposit: A Complete Information

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Navigating the 2025 IRS Calendar for Direct Deposit: A Complete Information. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Navigating the 2025 IRS Calendar for Direct Deposit: A Complete Information

The Inner Income Service (IRS) depends closely on direct deposit for each tax refunds and funds. Understanding the IRS calendar for direct deposit in 2025 is essential for taxpayers, making certain well timed receipt of their funds and avoiding potential delays. Whereas the precise dates for 2025 aren’t launched far prematurely, we will extrapolate from earlier years’ schedules and present IRS practices to supply a complete overview and useful methods for managing your direct deposit expectations. This text will discover the important thing facets of the 2025 IRS direct deposit calendar, providing insights into potential timelines, components influencing processing instances, and proactive steps taxpayers can take to make sure clean and environment friendly transactions.

Understanding the IRS Direct Deposit Course of:

Earlier than delving into the projected 2025 calendar, it is vital to grasp the mechanics of IRS direct deposit. The method includes securely linking your checking account data to your tax return. This data is verified by the IRS, and as soon as your return is processed and permitted, the funds are electronically transferred to your designated account. The velocity and effectivity of this course of rely upon a number of components, together with:

- Accuracy of Data: Errors in your banking particulars (account quantity, routing quantity, and many others.) will inevitably trigger delays. Double-checking this data earlier than submitting is paramount.

- Tax Return Complexity: Easy tax returns are sometimes processed sooner than these with advanced deductions, credit, or changes.

- IRS Processing Capability: The IRS handles hundreds of thousands of returns every year. Throughout peak submitting seasons (sometimes February to April), processing instances will be longer on account of elevated workload.

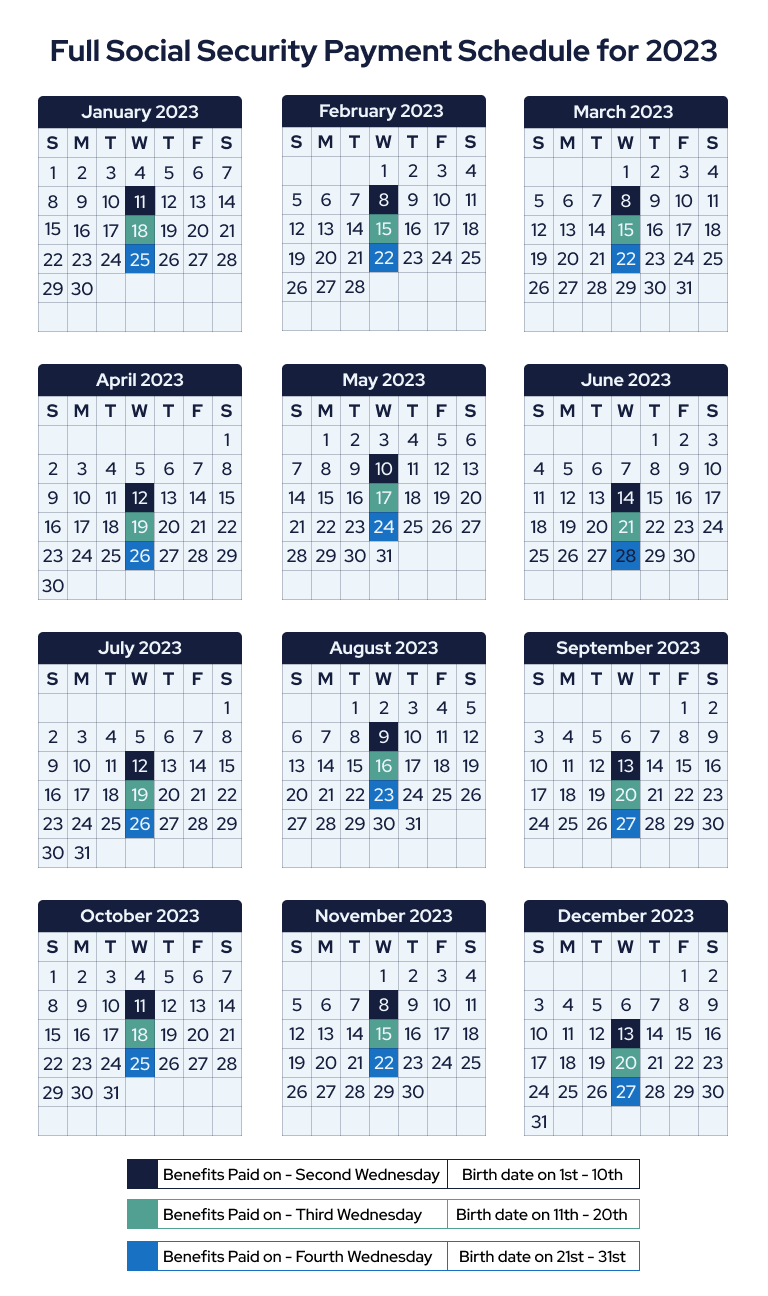

- Taxpayer Identification Quantity (TIN) Verification: Matching your TIN together with your Social Safety Administration (SSA) information is a essential step. Any discrepancies can result in delays.

- Financial institution Processing Occasions: Whereas the IRS transfers funds electronically, your financial institution could take further time to publish the deposit to your account. That is sometimes a matter of hours, however may very well be longer relying in your financial institution’s insurance policies.

Projected 2025 IRS Direct Deposit Timeline (Primarily based on Earlier Years):

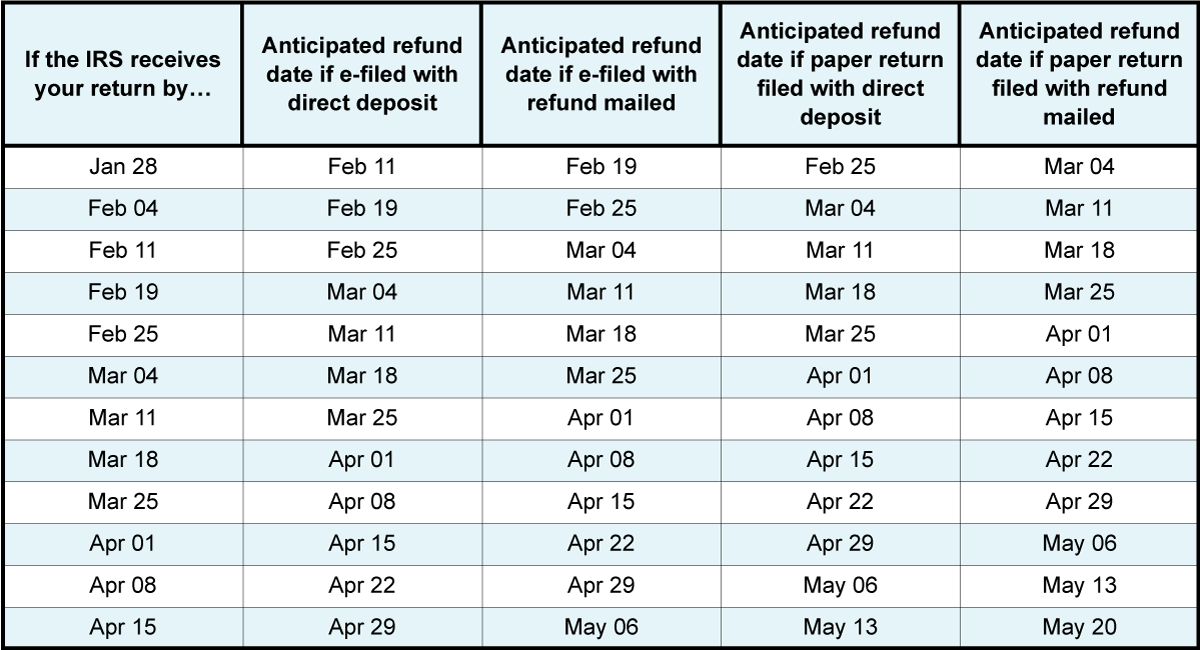

Predicting the precise dates for 2025 is unattainable this far prematurely. Nonetheless, primarily based on the historic patterns of earlier years, we will anticipate a common timeframe:

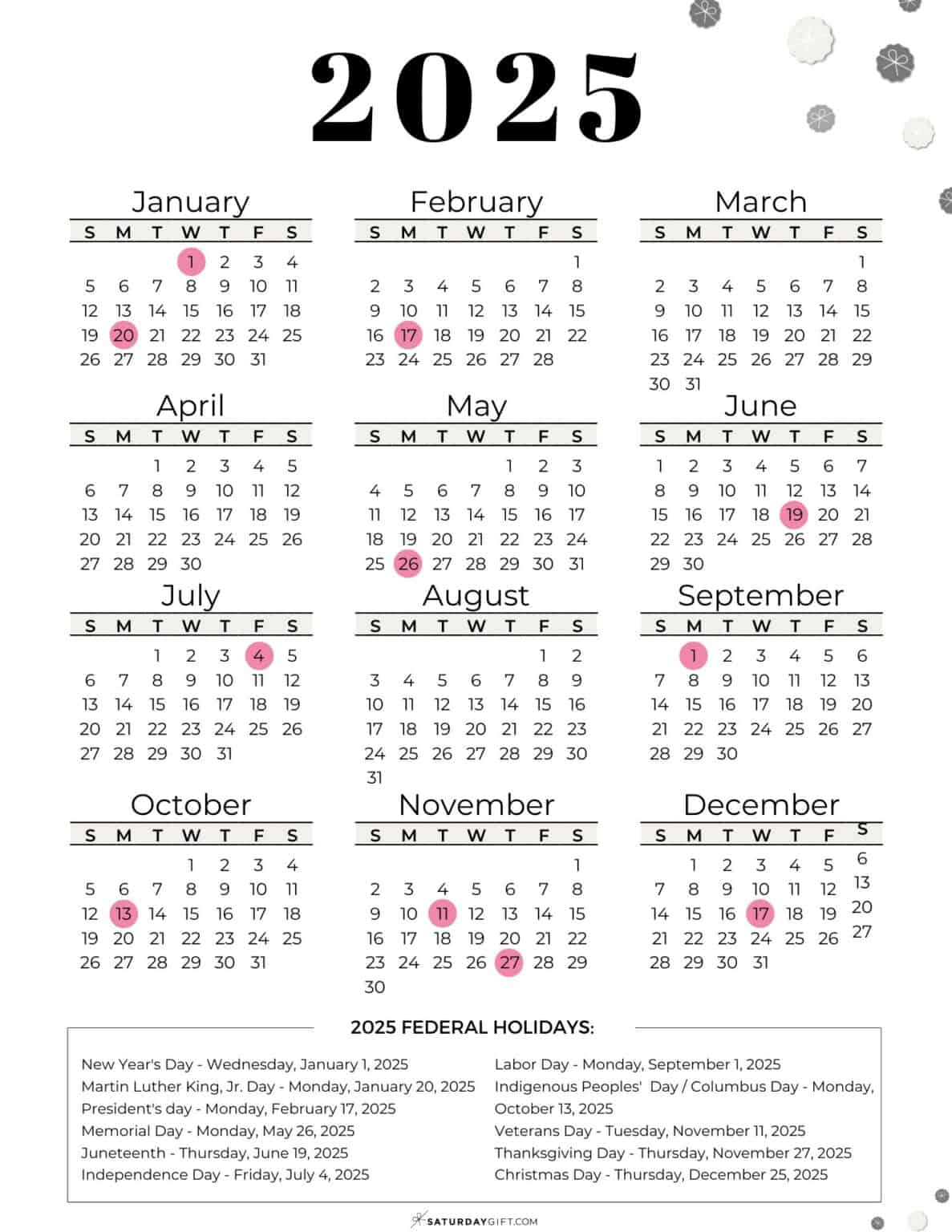

- Tax Submitting Season Begin: The IRS sometimes opens its e-filing system in late January or early February. This permits taxpayers to file electronically and obtain their refunds by way of direct deposit as quickly as potential.

- Peak Submitting Season: February by way of April often characterize the height submitting season, characterised by a excessive quantity of returns and probably longer processing instances.

- Refund Processing Time: For easy returns filed electronically with direct deposit, the IRS goals for a refund inside 21 days. Nonetheless, this timeframe can differ relying on the components talked about earlier. Advanced returns could take considerably longer.

- Tax Fee Deadlines: Tax cost deadlines are sometimes in April (for many taxpayers). Direct deposit of tax funds is inspired by the IRS for well timed and safe transactions. The IRS typically supplies particular dates for quarterly estimated tax funds all year long, and these are sometimes processed inside a number of enterprise days of the cost date.

Methods for Guaranteeing Well timed Direct Deposit in 2025:

Taxpayers can proactively improve the chance of receiving their refunds or funds on time by way of a number of methods:

- File Electronically: E-filing is considerably sooner than paper submitting. It minimizes errors and permits for faster processing.

- Select Direct Deposit: Direct deposit is the quickest and most safe methodology of receiving your refund or cost.

- Confirm Your Banking Data: Rigorously overview your checking account particulars earlier than submitting your tax return. Any errors can result in important delays.

- Use IRS’s On-line Instruments: The IRS web site supplies numerous instruments to trace your refund standing, examine your account data, and handle any potential points.

- File Early: Submitting early, particularly earlier than the height season, can decrease the chance of delays.

- Put together Your Paperwork: Collect all vital tax paperwork nicely prematurely to make sure a clean and environment friendly submitting course of.

- Contemplate Tax Software program: Tax preparation software program may help you precisely full your return and establish potential errors earlier than submission.

- Contact the IRS if Needed: Should you encounter any points or delays, contact the IRS immediately by way of their official channels for help.

Potential Challenges and Issues for 2025:

Whereas the IRS strives for effectivity, a number of components may probably influence direct deposit processing instances in 2025:

- Elevated Taxpayer Quantity: Modifications in tax legal guidelines or financial circumstances may result in a better quantity of tax returns, probably growing processing instances.

- System Upgrades or Upkeep: The IRS could undertake system upgrades or upkeep that would briefly have an effect on processing speeds.

- Surprising Circumstances: Unexpected occasions, comparable to pure disasters or cybersecurity threats, may disrupt operations and trigger delays.

Conclusion:

Whereas the exact 2025 IRS direct deposit calendar stays unknown presently, understanding the final timeline and potential components influencing processing instances is essential for taxpayers. By following the methods outlined above and staying knowledgeable about IRS bulletins, taxpayers can considerably enhance their probabilities of receiving their refunds or funds effectively and on time. Bear in mind to all the time use official IRS channels for data and help, avoiding third-party web sites or companies that declare to expedite the method for a price, as these are sometimes scams. Proactive planning and correct data are key to a clean and profitable tax season in 2025. Keep vigilant, keep organized, and keep knowledgeable to navigate the IRS direct deposit course of successfully.

Closure

Thus, we hope this text has offered precious insights into Navigating the 2025 IRS Calendar for Direct Deposit: A Complete Information. We hope you discover this text informative and useful. See you in our subsequent article!